Small print for start-ups

Click here to download this article in PDF format.

This is the best article you will ever read and it will guarantee you success and change your life (terms and conditions apply*).

For businesses both big and small it is all too commonplace for contracts to be agreed without either reading or understanding them. For consumers, there are legal protections against unfair terms being imposed on them by businesses. For the most part between

commercial organisations there is much more freedom to contract, and much less protection in the event that the terms are unbalanced between the parties. There are, as there often are in law, exceptions to this general rule, but the “basic” position is one of “business buyer beware”.

Historically the Courts (and to date Parliament) have considered that largely it is for businesses to sort out their commercial contracts without much need for protection and have left business to business (B2B) arrangements largely unregulated**. This may well make sense between two large well-resourced businesses, but the relevant legislation does not differentiate between a multinational business with offices world-wide, and a team of lawyers at HQ, and your new company with only perhaps one or two entrepreneurs as the shareholders and directors. As such, every business needs to know what it is signing up to when it agrees a contract, and it may find itself stuck with the terms, however unfair these are felt to be.

The essential guidance for new business is therefore to read the contracts you are agreeing to be bound by. The law assumes that if you have signed a contract, that you have in fact read it. Except for a very small number of contract types, the law does not require contracts to be signed at all. As the majority of those reading this article will be online businesses, this will, of course, be something of a relief as “signing up” new customers would be much less efficient if this actually involved printing and signing your website terms. Just as consumers can tick boxes to be bound to an agreement, so can businesses.

The term in the small print that has caused repeated annoyance for clients has been the rolling contract term. These automatic contract extension terms are now regulated for consumers, but still commonplace and unregulated in B2B contracts.

These terms provide for the automatic extension of contracts adding a new term at the expiry of the old term. This may be welcomed by a business wanting to keep the contract going with a supplier. However, such a term would be unwelcome where the supplier has not proved to be one that the business would wish to keep using. These clauses can be problematic if ending the new term involves a termination payment for cancelling the contract.

Problems with such a contract term can be mitigated by businesses who are aware of them. Usually such clauses require giving notice at least a specified number of months before the contract is expected to end. Some contracts do not have a maximum period of notice and where there is no maximum, giving notice at the outset of the contract that this will not renew mitigates all risks of automatic renewal. Where a specified period of notice is set, then ensuring that the business has a record of this, and actions any decision to renew or not renew, mitigates the risks of an automatic rolling contract.

As such, our major tip for new (and old) businesses (large and small) is to ensure that you read and understand the B2B contracts you sign up to as you are almost certainly going to be bound to them. With B2B contracts for basic suppliers if you have read and understood the contract, you may rarely need specific legal advice on the terms. Of course, if you do not understand them then you should consider seeking such advice if the contract is of sufficient value or complexity.

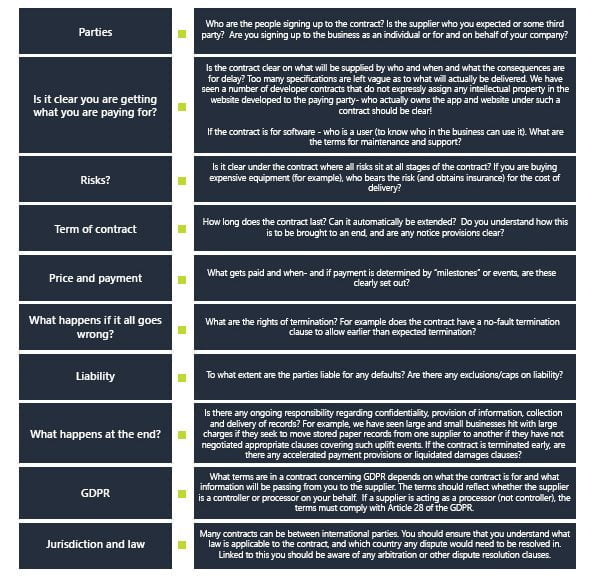

When reviewing any contract you should, as a minimum, understand the provisions covering:

We will, in future editions of our digital newsbrief be covering tips on agreements between business partners and online contracts and consumer protection- what your contract must say (and should not say!).

* The terms and conditions are that this may not be the best article you ever actually read, but we thought you might like it. It will not guarantee success, but might help you avoid some pitfalls, and if not actually change your life at least fill a few minutes.

**The main exception to this concerns where businesses have contracted with the other on their standard terms i.e. without negotiation. In such contracts some (but not all) clauses may be subject to a test of reasonableness.

We have just launched the summer edition of our #DigitalNewsbrief which provides an update on a range of commercial and legal issues as well as a focus on current clients of Hempsons. Click here to read: https://t.co/sj8hrA6WzE #Digital #DigitalHealth #Healthcare pic.twitter.com/axnj76kAR0

— Hempsons (@hempsonslegal) July 16, 2020